--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

My interest in Covanta pre-dates this

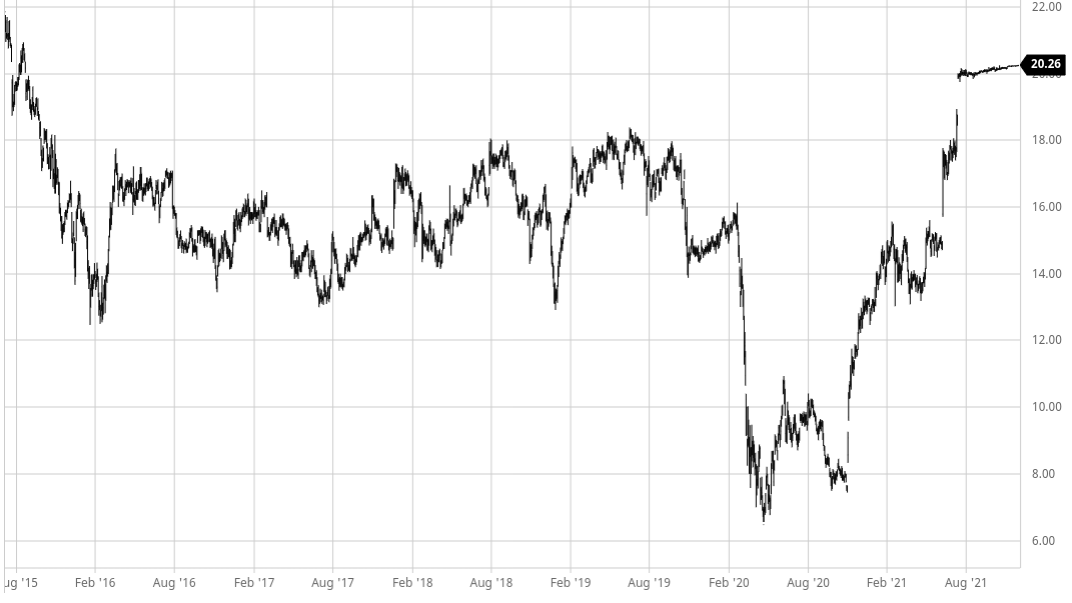

service, and I cut the stock in early July of 2015, soon after I

began publishing here while CVA was still priced above $21. The

shares never regained that value and promptly fell 40%. I reinstated

coverage the following February with CVA at $13.

My interest in Covanta pre-dates this

service, and I cut the stock in early July of 2015, soon after I

began publishing here while CVA was still priced above $21. The

shares never regained that value and promptly fell 40%. I reinstated

coverage the following February with CVA at $13. Covanta is the largest EfW (Energy from Waste) in the United States, and was growing into global services with new facilities in the British Isles. Since the JV with Macquarie, I'd looked for deals or other restructuring to unlock value. However, I became wary in the wake of the board coup and gave some warning of management's dividend cut in the midst of the pandemic. Ultimately the private equity route was taken to realize value.

I don't like how it played out, but the yield and several financial media articles which overemphasized the metal and energy aspects of the business while ignoring the mainstay income from long-term waste disposal contracts with local municipalities created opportunity for both steady income and more active investors. Overall, CVA was a quite profitable holding for me, and I think the coverage here serves as an example of how warnings can be just as valuable as new investment ideas.

CrowdWisers™

CrowdWisers™