--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

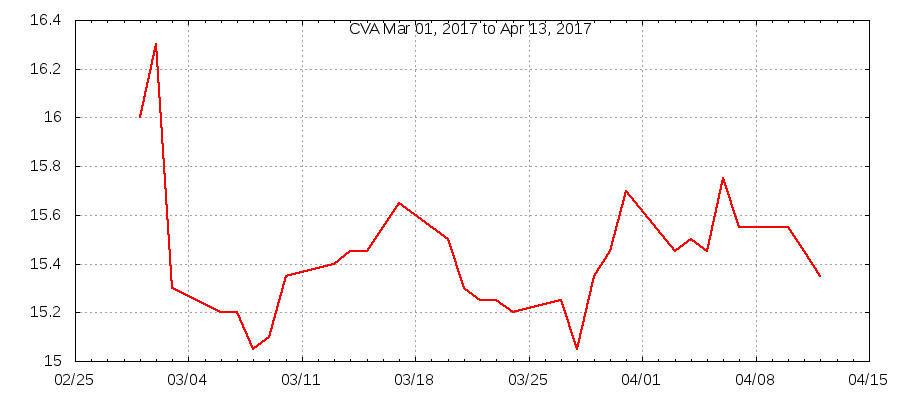

Covanta schedules 1Q17 report ?2

16:54 13-Apr-17

Covanta is set to deliver the report on its first quarter before the market opens on April 26th. The average projection from analysts is for a loss of 20 cents per share on $401M with current quarter revenue climbing to $418M.

Note that Q1 & 2 are seasonally weak in terms of EPS. Thus

the Goldman downgrade

that brought the stock down from the $16 level at the beginning of

March was well-timed, but only in terms of gaming the short-term

market, so far as I am concerned. I see the rebound on continued

volume immediately after CVA went ex-dividend on

March 28th as evidence of institutional chicanery and I made good

money there by NOT trying to time the market.

The next dividend won't come around until the end of June, so I

don't expect this report to change the stock's dynamic

immediately. Personally, I will continue looking to the

long-term, and listening for updates on the company's metal

processing, ash use and international expansion initiatives.

CrowdWisers™

CrowdWisers™