--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

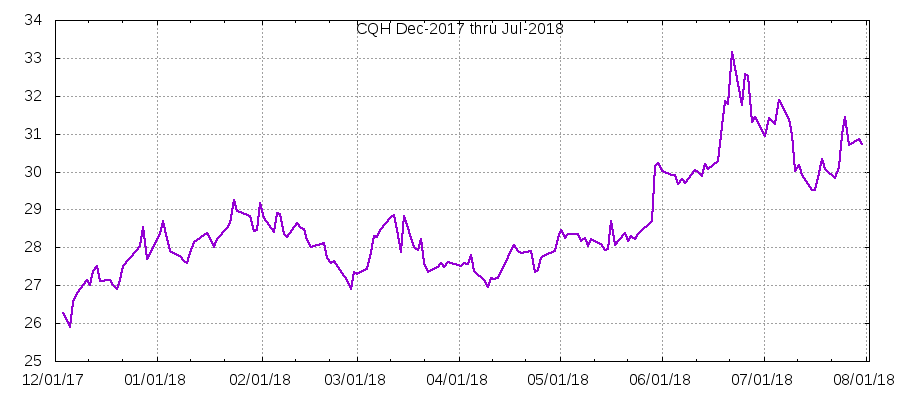

It was announced in mid-May that Cheniere Energy Partners would be folded back into the parent company. Consequently, this section is no longer updated and will go public at some point. The related Holding company mainly owned CQP shares and converted its MLP distributions into dividends. I saw this as a good way to get fairly stable high yield with the potential to grow in step with rising demand for LNG.

Although the investment was short-lived, it earned about ~40%

annualized return including dividends. Now this section serves as

an example of how continuing coverage is just as important for

exit strategies (see the INVN section

for another example of that), and how many of my best ideas never

see public coverage while they are viable.

| Updates: | ||

|---|---|---|

| ?2 | final CQH/CQP distribution? | 09:36 27-Jul-18 |

| +2 | natural gas stock pricing follow-up | 11:57 30-May-18 |

| +2 | CQH fold-in and other natural gas and telecom follow-ups | 16:15 17-May-18 |

| +1 | Schlumberger schedules 2Q18 report and more | 14:51 16-May-18 |

| +4 | CQH, CTL and macro notes | 09:59 04-May-18 |

| +2 | CQP distribution increase | 10:03 27-Apr-18 |

| +1 | gas earnings | 09:33 22-Feb-18 |

| +2 | CQP dividend, UDC agreement and more | 17:05 23-Jan-18 |

| ?2 | Fluence now official and more | 12:02 11-Jan-18 |

| +1 | BGC cleared as an OTF and MTF and more | 17:35 28-Dec-17 |

| +2 | CQH OMIB and year end notes | 23:15 23-Dec-17 |

| ?3 | year end energy update | 08:29 21-Dec-17 |

| +4 | SLB, AES and new natural gas picks | 02:25 01-Dec-17 |

CrowdWisers™

CrowdWisers™