--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

RESN & CWEN pre-earnings heads up ?3

10:30 04-Nov-19

Resonant has announced

a partnership with Teledyne Scientific, which is devoid of any

quantified detail. However the quotes from each company's

management make it sound like this partnership will focus on

optimizing manufacturing processes for 5G New Radio (NR) and WiFi

filters in the 3 GHz to 38 GHz range.

For my part, I confirm that Teledyne is a very well run company

with well-matched capabilities

for Resonant, and you can add any near-term financial impact from

this to the list of things that I will be looking for in

tomorrow's report. Technologically speaking, this is a

partnership that will probably take a few years to really bear

fruit, but once it does, it could very easily be too late to take

advantage of the opportunity in RESN.

In the meantime, a little more color on Clearway. I think the Governor's threat to takeover PG&E does increase the likelihood of an accelerated process. What that means for CWEN shareholders in the short term is still unclear, but I think this morning's buyout of Pattern Energy Group (PEGI) is relevant to the longer term market valuation. It comes at a premium to pricing over the last year, but less than post-IPO pricing and what the market was hoping for since buyout news first surfaced in mid-August. Clearway investors have typically asked me about PEGI and I've always characterized it as being not as well-run or fiscally disciplined. I've said before that there are no virtuous parties in the PG&E debate, and that includes government. Nonetheless, I think this morning's news offers perspective on how CWEN(A) investors will be just fine over the long term, regardless of what happens in California.

I think the same holds true for Golar and Shell, over the

medium-term. Now that we have some numbers

from Aramco, natural gas is now above $2.80 and Brent above

$62.50. Though FUD abounds,

and the long-term decline in hydrocarbons is clear, the full

technological solution is much further

off than Resonant's. The rise of global balkanization

benefits these companies in the meantime. In an otherwise challenged

market, these look like some of the best options for those who can

ignore the

news and volatility.

Clearway investors should take note that California's governor intends to meet with PG&E stakeholders this week in an attempt to fast-track the bankruptcy process. Despite tough political talk, my guess continues to be that California will follow through on initial steps taken to mitigate its reverse-indemnity laws and honor its renewable PPAs. Only the latter part matters to Clearway, but there can be no certainty in this macro environment.

The rest of this note will concern Resonant, whose shares rose over 20% yesterday. That's not so unusual for a depressed and thinly-traded GRoDT ahead of earnings. At first I thought the move was simply pre-earnings short covering and reaction to an S-3 filing reminding us of Murata closing its stake at $2.53 per share. However, it seems that the primary factor was documentation redux of a design win for Samsung's Galaxy XCover4S, this time via a private note from the same RESN perma-bull.

Same Catalyst

Now as then, I believe the identification is correct but of limited fundamental importance to the market, since in each case we already had rough figures from Resonant. I had already said that a sling-shot effect was likely, and am happy to see it regardless of the catalyst. Note, though, that back in July of 2017, the market reaction was of similar magnitude, and very short-lived.

By contrast, the reaction to the subsequent earnings report was much more dramatic and somewhat less ephemeral before the specter of continued dilution began taking a severe toll. Furthermore call quality and touchscreen problems with the original XCover4 probably contributed to Resonant's failure to ramp revenues as predicted. I've seen no such trouble with the 4S so far, but it's important to remember that this is still a rugged niche phone designed for harsh work environments.

Different Situation

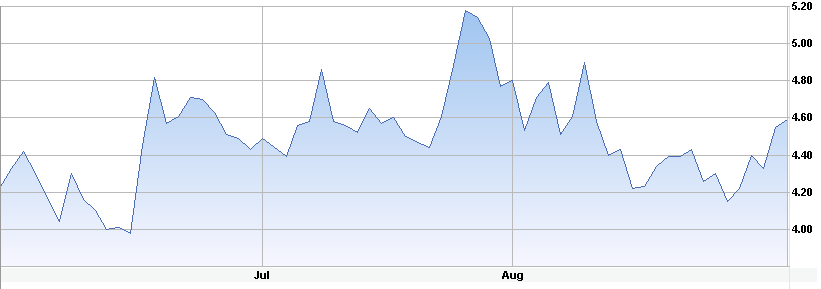

That said, there are some significant differences today. Of course, the main thing that has changed is Murata taking a stake in Resonant. It is now clear that Murata was a customer for one of Resonant's initial innovations 2 years ago, and that it extended the component into two other ill-fated models from Sony and ASUS. Those use cases explain Resonant's sagging revenue, but they did serve to give Murata experience with the RF filter component, which has since been lauded as ground-breaking. It's typical to for major vendors to test out new component types in limited release phones like this, and since the 4S was just released in July, we can figure that design into higher volume models will have to wait until well into 2020. Perhaps its just coincidence that warrants expire with the third quarter, but I think that serves as a good time frame for the $3.35-4.85 price range that I've targeted before we can start to look forward to XBAR and 5G development details.

When we'll get there is always the harder, but to me, less important question. As of October 15th, about 3.5M shares were shorted, up slightly after more junk analysis on Seeking Alpha. The figure is around 12/16% of the post/pre-Murata transaction float. That's enough to for a short squeeze if management is convincing about the revenue ramp. However, that will be harder to sell the second time around, and I've already warned about the implied disappointment for the third quarter numbers on Tuesday, which could then be made worse by tax loss selling. Extreme volatility is par for the course with GRoDT stocks, and there are other options for those who are bothered by it. For the rest of us, significant eventual upside remains.

CrowdWisers™

CrowdWisers™