--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

MVIS, BEVs, AI, and a dangerous market -3

11:12 16-Jun-23

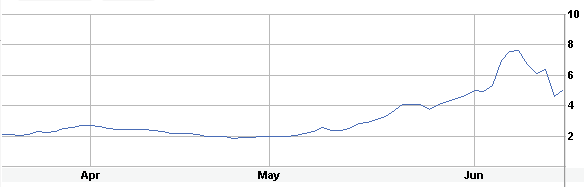

MicroVision recently attempted

a $75M private placement, only to abandon

it, and follow up immediately with a $45M

ATM facility. MVIS has been a roller coaster since its latest

earnings report

in early May, which featured a forecast for yet another

huge jump in revenue to levels which still wouldn't be profitable.

Analysts bit on that, but they were either ignorant, or happy to

profit from volatility at the expense of those who believed them.

MicroVision recently attempted

a $75M private placement, only to abandon

it, and follow up immediately with a $45M

ATM facility. MVIS has been a roller coaster since its latest

earnings report

in early May, which featured a forecast for yet another

huge jump in revenue to levels which still wouldn't be profitable.

Analysts bit on that, but they were either ignorant, or happy to

profit from volatility at the expense of those who believed them. My service has shown the ability

to profit from such short term moves, but it offers only

long-side analysis for reasons which I am happy to explain to anyone

that cares to ask. I think history validates my decision

to drop coverage on the stock, per this sentence from the MVIS section

summary:

My service has shown the ability

to profit from such short term moves, but it offers only

long-side analysis for reasons which I am happy to explain to anyone

that cares to ask. I think history validates my decision

to drop coverage on the stock, per this sentence from the MVIS section

summary:early warnings had me playing hands off a few years later, and experience made me want nothing to do with later management.Since those link dates, MVIS went from bounding around $3 to to low of 15 cents before being rescued by the pandemic-inspired swarm trading craze. This note is being published primarily to serve as a background example for the macro analysis on the private side of this website, but I hope it also serves as a warning to those who think that this time is different for MicroVision: in my opinion as a programmer and investor, the company has no competitive expertise or capabilities in artificial intelligence, and has demonstrated complete inability to bring cost effective solutions to the growing battery electric vehicle market, which I've been accurately predicting for years now, in part through hands on experience.

CrowdWisers™

CrowdWisers™