--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

Xebec acquisition, PPL closing and more macro +3

14:39 16-Jun-21

The market took a pronounced dip as

the FOMC statement

was released, but as I surmised below, the Fed's not ready to change

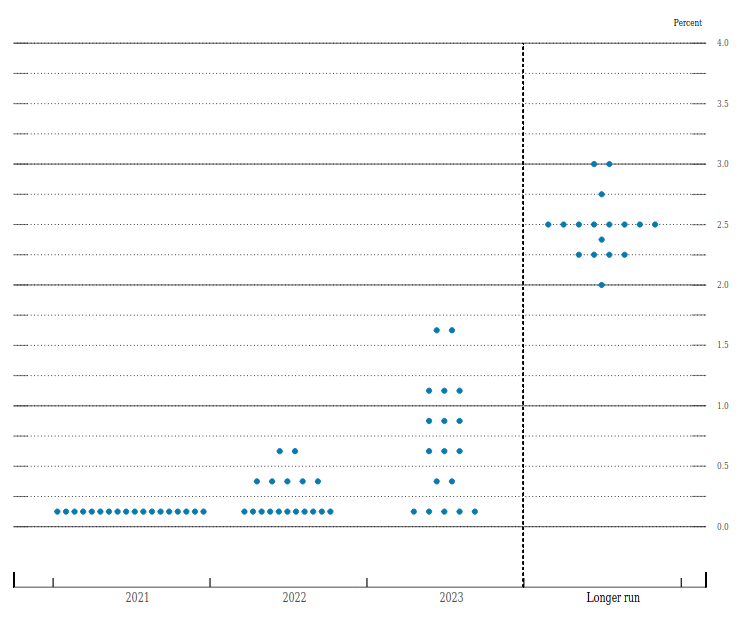

its tune just yet. Even so, today's dot plot looks substantially

steeper than the one I referenced

in mid-March and the market is focusing on that for the moment.

Powell & Co. continue to label inflation as transitory, as if

that matters.

The market took a pronounced dip as

the FOMC statement

was released, but as I surmised below, the Fed's not ready to change

its tune just yet. Even so, today's dot plot looks substantially

steeper than the one I referenced

in mid-March and the market is focusing on that for the moment.

Powell & Co. continue to label inflation as transitory, as if

that matters. What's

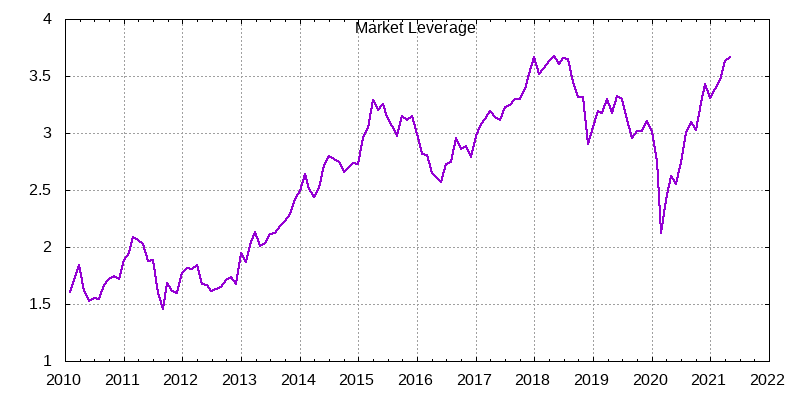

more important to me is that market leverage slowed in May, but it's

not getting better as shown by my charting of FINRA data.

What's

more important to me is that market leverage slowed in May, but it's

not getting better as shown by my charting of FINRA data.So, while I think the market reaction to today's statement is also likely to be transitory, I continue to worry that the bull run is coming to end, possibly in the August to September time frame. At best, I would be very surprised if we make it through next year without a seeing index lows more than 20% below current levels.

On 6/14/21 12:16 PM, Esekla wrote:

Xebec has acquired Tiger Filtraton for £12.0M and says the deal will be immediately accretive by reducing costs and expanding its service revenue. I like this best of the recent deals, even though XBC & XEBEF are down slightly this morning. The stock may have been left for dead, after the issues I predicted, but the broader market says otherwise with North American gas at $3.30, TTF at €29, and JKM at $11.50. The latter two have shown record activity and Telus spreading the emphasis on ESG is spreading makes this a signpost for Xebec's bright long term future.

Traders aren't looking that far ahead these days, though. They're beginning to worry about a change in messaging from the Fed on Wednesday, and sweating the details in energy like Iran supply and Shell fracking assets. Even fossil gas is being pressured, though more in distribution than production. I continue to worry about long-term destabilization of the Middle East, which takes me back to utilities, with PPL Corp. officially closing its U.K. sale, and beginning debt reduction, all as predicted last week. This will be a tricky time for the stock, with the next 41 cent dividend not due until September, and probably only one more at that level in December. However, I reiterate that the company is a clear path to investment grade and will have over $3b or $3.90 per share to invest in buybacks or transformative investment. I think that positions PPL more ideally than ever as parts of America finally begin to implement superior voting systems that have long been staples for the rest of the democratic world.

The rest of my macro messaging from last week deserves reinforcement also, particularly on BGCP and VIRT, after NYSE markets followed up confirmation of my volume prediction with a report of record open interest this morning. That note also warned about Fed willingness to crash the market. I have doubt about it happening on Wednesday, but a few months makes little difference to me at this point.

CrowdWisers™

CrowdWisers™