--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

What to do about bank failures... ?4

21:50 01-May-23

Today the FDIC issued a report detailing options for bank deposit insurance reform, presenting three main possibilities:

- Limited Coverage: maintaining the current system, but probably with a higher cap on the insured amount per account.

- Unlimited Coverage: fully insuring all deposits.

- Targeting Coverage: substantially increasing coverage to business payment accounts, and potentially limiting withdrawals from them, without changing the parameters for other accounts.

Although

the report correctly concludes that #3 is the most promising

option, even that misses the point. It admits that there are

"significant unresolved practical challenges" to this option, and

I posit that is at least partly because the entire monetary system

is fundamentally

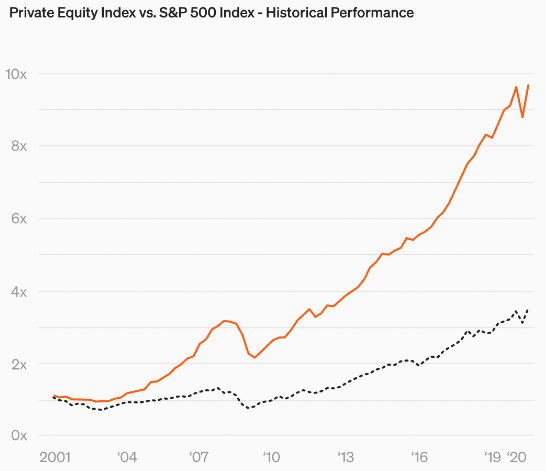

flawed. I think it is no coincidence that venture capital firms Kleiner

Perkins and Sequoia

Capital were founded sooner after. The flip side of venture

capital is private equity, which began to boom the following

decade, and has outperformed

the S&P500 index by a factor of 3x over the past two decades.

There is mounting evidence

that private equity firms are toxic to society, yet such entities

are the ones who benefited most when the rules were changed

for Silicon Valley and Signature bank depositors.

Although

the report correctly concludes that #3 is the most promising

option, even that misses the point. It admits that there are

"significant unresolved practical challenges" to this option, and

I posit that is at least partly because the entire monetary system

is fundamentally

flawed. I think it is no coincidence that venture capital firms Kleiner

Perkins and Sequoia

Capital were founded sooner after. The flip side of venture

capital is private equity, which began to boom the following

decade, and has outperformed

the S&P500 index by a factor of 3x over the past two decades.

There is mounting evidence

that private equity firms are toxic to society, yet such entities

are the ones who benefited most when the rules were changed

for Silicon Valley and Signature bank depositors.

Hopefully we can all agree that some of the wealthiest entities in, and most deficient contributors to, our tax base are not the ones who need saving. The rationale for making exceptions to the rules was to save the payrolls and operations of the companies involved. Therefore, I propose a simpler, deeper change to our financial system that would accomplish that without more complex and clearly unreliable regulation:

Make corporate payrolls a debt obligation that is senior to all others, including bondholders.

Doing so would allow poorly operated banks and business to fail, as they should, without hurting the the people who do the work. Existing deposit insurance is completely adequate for the working class, as documented by today's FDIC report:

more than 99 percent of deposit accounts were under the deposit insurance limit as of December 2022.Making changes to bank regulation is not the answer. The working class already pays the burden of layoffs through unemployment insurance. Making payrolls the most senior of debt obligations for at least the same length of time would not only be a simpler solution, it would ease the broader public burden. In short, bank failures aren't the problem, our debt priorities are. The latest round of bank problems shows the need to impose some responsibility on those who already take most of the profits and let them appropriately bear the risk incumbent in the banking partners they choose.

Any of the changes that the FDIC is proposing today would require Congressional action anyway. Do what you can to try help Congress get it at least a little more right this time.

CrowdWisers™

CrowdWisers™