--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

FIT and record markets ?3

13:52 27-Dec-19

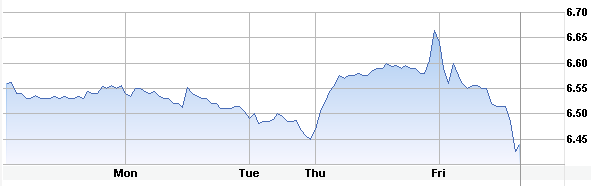

It took longer for news flow and corporate actions to slow down than I expected, but they have. The most interesting things to happen this week have been momentary dips in FIT to $6.42.

For the

record, prices near or below that level interest me, as they

represent about a 17% spread. Shareholders are set to vote on

January 3rd, and I have little doubt they will approve the merger,

that it will receive subsequent regulatory scrutiny, but wind up

being consummated. The FIT section of the website will go public

with the new year, but updates will continue, if there is anything

to report.

For the

record, prices near or below that level interest me, as they

represent about a 17% spread. Shareholders are set to vote on

January 3rd, and I have little doubt they will approve the merger,

that it will receive subsequent regulatory scrutiny, but wind up

being consummated. The FIT section of the website will go public

with the new year, but updates will continue, if there is anything

to report.Brent topping $68 is also of interest, and good for Shell and Schlumberger, if such prices can be sustained or increased. Aramco briefly achieved its $2T valuation, albeit with a low-float IPO, and RDS(A/B) is just above my $60 fair value, but pressure from renewable energy continues. In my view, battery availability and pricing will be the critical factor control adoption over the next several years. The spread over WTI is up to $6.40.

I'll be watching this against a backdrop of increasing social unrest next year, which is driving global fragmentation on many levels. Some places are pushing back, but lack of consensus in America will only make its election outcome of importance for short to medium term investment; any real repair needs to go beyond politics. Europe has been better about consensus, and India hangs in the balance, though there are signs of hope. In this context, it's disappointing that we've heard nothing on selection of a global banker for the EbixCash IPO, but no news isn't always bad news, and getting it right is more important than getting it quickly.

The market has been hitting new record highs as we close out the year, but not for good reasons, so far as I can see. We've now passed my original guess for the outer limit of the bull market, though I've consistently seen possibilities of extension since. Nonetheless, I've been right about shale, manufacturing has gone nowhere, and banking looks like the next disrupted sector. It will be a small miracle if Lagarde can transmute that challenge into progress, but it needn't happen right away. In the meantime, inflation flowing into the markets might still run several more months before being overtaken by fundamentals. I continue to like BGCP and CVA and will leave you with some subscriber conversation on the latter. I see these stocks as having limited downside for the short to medium-term risk inherent in current market levels as well as to long-term growth potential. However, at such times, the simple arbitrage being offered by FIT may be just as good an option. I wish you all a happy new year!

On 12/27/19 1:08 PM, Esekla wrote:

I looked into the plastic problem for Covanta back in May, and have been concerned about it for much longer (see the "technological" link towards the end). A little expansion on what I found is that the company would prefer to see plastics recycled, but can handle increased amounts in the mix with additives to the process.

There is always push back, but Covanta does regular air testing of their emissions, including for dioxins, and issues an annual sustainability report. In the end, their solution has to be compared to other options, and it looks best me. It's also worth mentioning that America is going the opposite direction under Trump's EPA.

I hope that helps,

Esekla

On 12/27/19 12:13 PM, a subscriber wrote:

From The New York Times:

Indonesia Lets Plastic Burning Continue Despite Warning on Toxins

The Indonesian government pushed back on an international study that found high levels of dioxin in a village where plastic is burned to produce tofu.

https://www.nytimes.com/2019/12/19/world/asia/indonesia-dioxin-plastic-tofu.html

Esekla,

This article from the NY Times indicates that burning plastic waste produces dioxins, which are toxic to humans. Chicago, where I live, used to have a waste-to-energy plant but it was shut down due to air pollution concerns, including, I believe, airborne dioxins. I recently bought more CVA based on your insights, but am concerned that CVA’s facilities may have the same dioxin problem, which to my mind will vastly limit their otherwise huge potential. Any thoughts about this? I should research the company and its technology more thoroughly!

Thanks for your most helpful and educational commentary during 2019!

CrowdWisers™

CrowdWisers™