--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

Fitbit & Google: What Citron Got Right, and Wrong ?1

10:30 16-Jun-18

- Citron Research recently issued a report declaring a $15 price target for Fitbit.

- From hands-on evaluation of a Versa purchased by CrowdWisers, we can confirm there is a lot that Citron got right.

- However, their report shows a trader's view of the market and

lacks forward-looking insight into the technology behind

wearables.

I'd like to begin by saying that I have a great deal of respect for Andrew Left and Citron Research. Short sellers often get a bad rap for essentially giving the market a dose of reality. Although many short attacks are misleading and inaccurate, Citron's are generally well-sourced and based in fact. That represents a refreshing dose of honesty as compared to the constant hype that is bandied by long sell-side analysts and pundits. Like any good short-seller, Andrew Left is a student of market dynamics, and I commend him for taking advantage of the opportunity in this situation. Now let's look at how long that opportunity is likely to last.

CrowdWisers Versa Evaluation Parameters

The Versa purchased by CrowdWisers was given to an active female professional for evaluation on May 4th. It's taken us quite a while get an assessment of the Versa out, and the reasons why are significant. Quick Replies and female health tracking features were announced as available just three days later. Despite this, the new functionality was not available on our model until May 14th. This is because Fitbit actually rolled the features out only very gradually in order to test them. Processes like this have become common, even with end-user devices, but as a programmer, I find them to be sad commentary on the state of both software development and consumer relations these days.

While we waited for the features we most wanted to test, the user quickly came up with the following list of Pros and Cons about the Versa's basic functionality:

Pros:

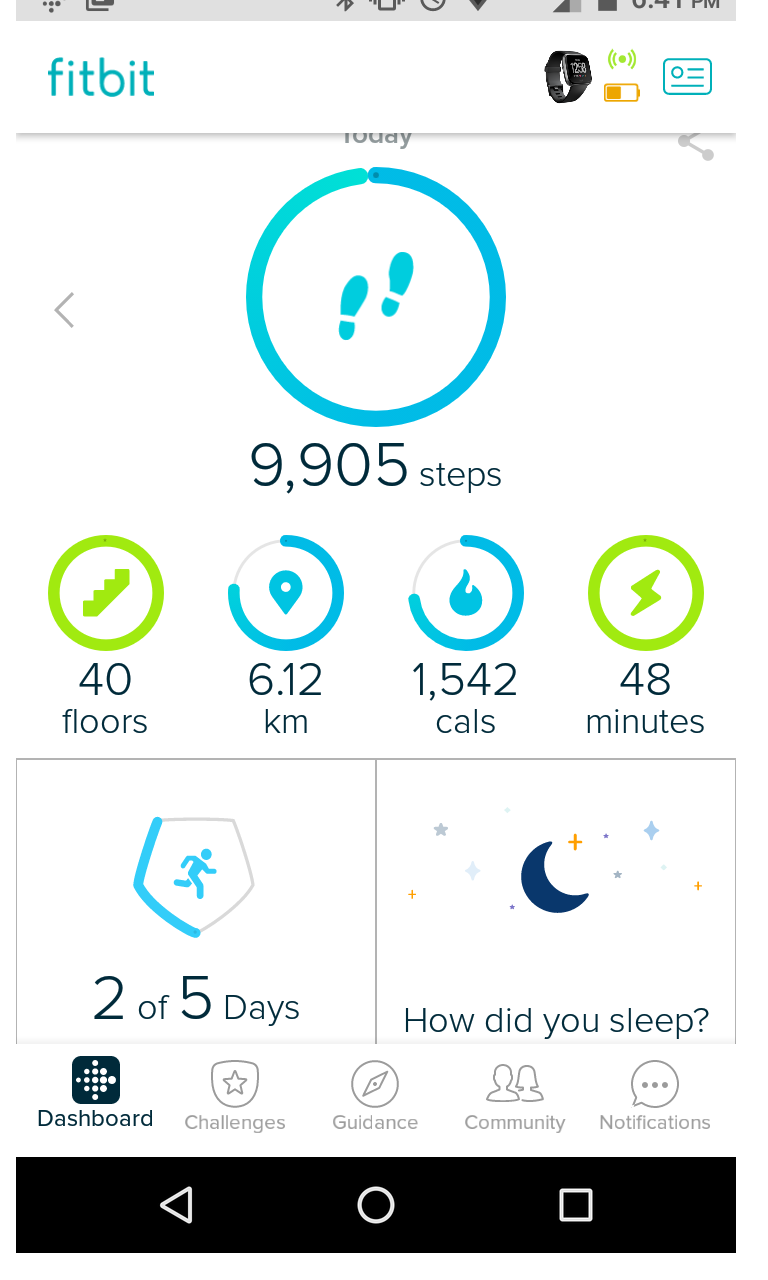

- Top-notch smart-phone interface to data: Fitbit has been consistently lauded in this area, and our tester added her kudos, particularly appreciating:

the

dashboard of activity for the day (see image to the right)

including calories burned, not just steps taken.

the

dashboard of activity for the day (see image to the right)

including calories burned, not just steps taken.

- the breakdown by hour of when she is active and how far she has traveled.

- automatic sleep tracking which appears accurate at least on

overall time, though it is more difficult to verify the REM,

Light, and Deep sleep figures.

- Improved activity tracking on the device: the Versa's activity tracking appears superior to prior generation devices. Our tester had previously owned a Sony Talkband, which routinely failed to measure some activities correctly. The Versa also appropriate differentiates between stairs and steps. That said, note that actual performance is also in the list of Cons, below.

- Battery Life: I can't stress this one enough. Like the

Ionic, the Versa allows you to go multiple days without

recharging, even when active. In this regard, it clearly bests

all competitors but Garmin (GRMN) which, as I've noted in prior

research, is on par because it and Fitbit are the only entrants

to roll their own hardware rather than relying on outdated

Qualcomm (QCOM) SoCs. More on this below.

- Water resistance: so she doesn't have to take it off in

the shower, is much appreciated.

- Aesthetics: the screen is bright and easy to read; some

have dinged it for large bezels, but this did not trouble our

tester. More importantly, the Versa is sleeker and lighter than

competitors, which is key for many female wrists!

- Connection reliability: there was a great deal of

difficulty reconnecting the Versa with her Moto E4 after loss of

connection.

- Support: initial attempts to troubleshoot this issue

got a rather bland response from Fitbit, asking us to try the

watch with other phones, and questioning compatibility. They

seemed to miss the point that the watch does connect, just not

reliably. To be fair, the phone is probably at least as much at

fault as the Versa. Our test user was able to pair reliably

with her iPhone, though the Versa will not use more than one

phone simultaneously. I've also touched base with other

multiple other Ionic users and they have not had problems

reconnecting. Nonetheless, the problems we experienced are the

sort of thing that software development teams work through all

time, and something that usually improves as the software

matures. It's no surprise that it has a long way to go, but on

the support side, if we were to espouse the stance initially

offered by Fitbit, then the company should be advertising the

Versa as only compatible with two

dozen Android phones, which we only got a list of after

more cajoling.

- Lack of features: The connection issues quickly brought to the fore that there is no alert when the Versa disconnects from the phone. Similarly, when the two are connected a Find My Phone feature is something that is available elsewhere and much requested by users, but so far pleas have been roundly ignored by Fitbit developers. Things like this speak to the poor third-party software ecosystem problem that I have highlighted in my Ionic review.

- Weak Notifications: our test tends to miss messaging

notifications when she is on the move because buzzer is simply

too weak. Other have reported this too, and it's shocking

(though not literally)

to me that Fitbit wouldn't code in some basic optionality into

such an important feature. The prior link is one potential

explanation; being forced into cheap device construction is

another.

- Motion Sensitivity and Lag: the Versa was not

sensitive enough to wrist motion to always give the time,

particularly when a discreet check was desired. Even when it

does register the wrist turn, there is a pause before it shows

me the time. For discreet checks, this means it's not seamless,

and even in other situations the delay quickly becomes a

significant annoyance.

- Activity Tracking Accuracy: although there has been

improvement, this is still far from perfect. For example, the

app registered 26 minutes of outdoor biking, but our tester

never bikes! Similarly, yoga classes were a total loss as far

as tracking was concerned.

Dancing with the Devil

This last point raises a point that I think is crucially

misunderstood by Citron and the overall market about the recent

collaboration with Google. Alphabet (GOOG) has literally

left any trace of its original "Don't be evil" motto behind. Most

consumers have become inured to the privacy concerns that should go

along with their personal data being stored on anywhere other than

on their own private devices. So the marketing impact of this new

agreement should be minimal or even slightly positive. What I'm

concerned with is the competitive trade off. Fitbit gets a more

reliable and capable cloud than the one that failed

it just before the agreement was announced. CrowdWisers published

research correlating that incident to problems

with Amazon's (AMZN) AWS services.What does Google get? Besides poaching a client, it gets information it can use to further its own health care initiatives, which is all well and good on the big data side where Fitbit was never realistically going to out-compete the behemoths anyway. However, on the data collection edges, where Fitbit makes its (meager, as of late) living, I posit that Google gets exactly the usage data it needs to fine tune its own wearable devices and the software that runs them. My position is supported by Fitbit's

Terms of Service

By making Your Content available on or through the Fitbit Service you hereby grant to Fitbit a non-exclusive, transferable, sublicensable, worldwide, royalty-free license to use, copy, modify, publicly display, publicly perform, reproduce, translate, create derivative works from, and distribute Your Content, in whole or in part, including your name and likeness, in any media.and its Privacy Policy

We transfer information to our corporate affiliates, service providers, and other partners who process it for usThese partners provide us with services globally, including for customer support, information technology, payments, sales, marketing, data analysis, research, and surveys. These partners provide us with services globally, including for customer support, information technology, payments, sales, marketing, data analysis, research, and surveys.I'm not claiming that Google is going to be spying on whether or not you slacked off last Thursday, though anyone who doubts the possibility of even that level of invasive analytics should revisit Facebook's history with Cambridge Analytica. The real danger here is that Google is able to make aggregate observations for fine tuning Wear OS, and showing what anyone who's really analyzed this space already knows: that the current generation of products are great motivational tools, but poor diagnostic devices.

As I wrote in my private coverage of Fitbit's 4Q17 report, Fitbit and Garmin have enjoyed temporary shelter from from Android competition because of stagnant hardware:

The one thing Fitbit does still have going for it in the short term is that wearable market is still the wild west. Per this article:Well, those days are about to be over with the introduction of a new SoC (system on chip) from Qualcomm (QCOM) this fall, which will probably debut with a Google branded wearable. It will be followed by host of new holiday season competitors with the vastly improved battery life that comes with modern foundry production. Expect that to be accompanied by plenty of technically independent media reports pointing out the flaws in current health data collection. However, I expect the deadliest point of comparison will be something I've harped on for a long time...

Android Wear is not a perfect smartwatch operating system, but the primary problem with Android Wear watches is the hardware, like size, design (which is closely related to size), speed, and battery life. All of these are primarily influenced by the SoC, and there hasn't been a new option for OEMs since 2016. There are only so many ways you can wrap a screen, battery, and body around an SoC, so Android smartwatch hardware has totally stagnated.That represents a barrier to entry, at least until Google starts taking a deeper interest.

Messaging

If you've been following my thoughts on wearables, you know that I think messaging is the other key feature (along with health tracking) for the market. Though some have wanted more, we found Quick Replies easy to use and reliable, assuming you become aware of the notification at all. However, Fitbit has not included any ability to dictate a response, likely because its software is not up to the task. Alphabet's clearly is, and I expect this functionality to really come to the fore in the next iteration of devices based on the hardware and software mentioned above. When it does, I think Fitbit is going to have major problems competing. Our test user supports this, sayingI like receiving texts, when it happens to be connected to my phone. Quick-replies are a nice to have, but honestly, I have not had too many scenarios when I use them because the conversation needs more than a canned response a lot of the time.I already dictate messages most of the time on my phones. I just don't see any way that Fitbit (or Garmin, for that matter) can match Google when it comes to voice recognition. Arguably, the Flyer headphones, which have a microphone, can simply interface to Android to make use of that functionality, as could a future watch with a microphone. Nonetheless, I think Fitbit's integration will lag that of native Android and iOS devices.

Financial Analysis

Fitbit hasn't been profitable since 2016, and my Ionic review correctly predicted that the trend would worsen as its smart watches were forced to compete on price rather than features. The Versa should temporarily mitigate that trend, but management's goal for this year is merely to get to break-even cash flow. With deadly new competition on the way, that puts the floor for FIT shares at cash on the balance sheet. My analysis of that as of the last report went like this:

The company had $658M of cash and equivalents on the balance sheet, no debt, and an $80M tax refund on the way. However, management admits that they don't have all the pieces for real healthcare integration in place, and they expect to get them through M&A. It also labels the new work with Google as being in the exploratory phase, and notes that it will free up engineering capacity.So, best case hard value, with the tax refund and not subtracting for health care integration expenditures is $3.51 per share. Note that this includes Fitbit's own projections on new revenue streams like Coach, which management said grew 30% YoY. That statement seems as squishy as those associated with the software roll-outs, as Coach was just introduced in August. No matter what the time frame is, the growth rate doesn't impress me for a new service.

Realistically, though, I don't think FIT will get below $4

without a general market crash, just based on years of trading

experience. However, once actual sales start to be reported in a

newly competitive environment, I can easily see FIT back below

$5. That represents over 30% nominal gain on a short position and

more on an annualized basis.

Buyout?

Another point raised by Citron is the possibility of buyout, which generally serves as a emotional refuge for desperate longs everywhere. It's impossible to refute definitively, since it is hypothetical, and offers a sort of deus ex-machina ending for what is otherwise a bad situation. Citron raises this point repeatedly, and I agree! Fitbit is likely to be bought, eventually, but that's not a reason to own it, as shown by the history of InvenSense. In fact, the share appreciation caused by Citron makes this possibility far less likely in the near term. Any would-be buyer which had done its due diligence would be looking for a better price while waiting for competitive factors to take their toll.Summary

Over the current and coming quarters, I suspect Versa sales will

improve Fitbit's unit numbers substantially, but its margins less.

Citron only needed to take a quick look at the factors I've detailed

in conjunction with over 14% shorted-float in order to identify an

opportunity to make a quick buck. I commend Mr. Left for a

successful market hack, but the resultant movement in FIT shares now

positions the stock better as market hedge,

or outright short, as we move towards 2019. Should Mr. Left wish to

take issue with the long-term analysis provided here, I invite

Citron to negotiate a public bet with CrowdWisers, based on Fitbit

fundamentals, with Seeking Alpha staff as the arbiters. Good investing is generally a marathon, not a sprint. New wearables based on the new Qualcomm SoC are likely to allow the Android ecosystem to shine in ways that will be difficult for others to match. Garmin may be somewhat insulated by its high-end market positioning but the going is likely to be especially tough on the value end of the market, where Fitbit has been forced. The latest data from Canalys also shows the company facing declining interest in its legacy trackers, as new, smaller competition starts moving that functionality from the wrist to the finger. Consequently, while Fitbit is seemingly start to hit its stride with the Versa, don't be surprised to see the company sucking wind again as we stride into 2019.

CrowdWisers™

CrowdWisers™