--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

Ebix business update +3

20:51 11-Jan-19

Ebix issued a 13

point business update today. The first two points, on

strength in the legacy insurance business, are most welcome,

though the only quantification is the signing of 4 new Annuities

carriers in the fourth quarter. Record business is Australia is

reassuring as well, but not particularly surprising. The company

also stated its intention to expand into "newer geographies like

Muscat, Abu Dhabi, Bahrain, Thailand, Malaysia, etc. in addition

to plans underway for meaningful growth in Dubai." The Indian

diaspora means that this is not just growth for growth's sake.

Some may find it a relief to hear that this expansion is expected

to be primarily organic. I would add that there is some evidence

of Ebix having meaningful insight into markets that I want

exposure to.

Some housekeeping issues also bear mentioning, chief amongst them

the update that the company has already executed on almost half of

its $100M buyback allocation. Almost a fifth of that even came at

a 2% discount. When I look at repurchases in combination with the

market dynamics, I have to wonder about what's going on behind the

scenes. Over 27% of float, or almost 7M shares, were

shorted at year end. 4M would be a more typical number and

the buybacks that have already taken place should increase that

shorted float percentage by another point. There is no rebate

rate to speak of, and 15 days to cover is high by normal standards

but not for this stock. The only significant open options

position is over 7K of $45 March puts. Although some of the

conditions are right for a short squeeze, it's hard to see that as

being imminent.

Instead, everything in the paragraph above implies that the

market still doesn't trust this company, and I can understand

why. Unlike many of the other companies I cover, Ebix management

does not inspire confidence. To that end, the continued

reassurances about tax and regulatory compliances are welcome,

though mostly redundant, and another report affirming correction

of past material weaknesses should be coming soon. Ebix's

repatriation tax under the new code is $21.9 million over 8 years,

on an interest free basis, which is pretty insignificant, while

the permanently lower tax rate plays well with long-term currency

dynamics. Put it all together, and it looks like time is on

shareholder's sides. Furthermore, I think the aggressive style is

the right approach for the markets it is entering, though much

will hinge on a successful IPO of EbixCash, the proceeds of which

should repay debt. That represents more of a risk than the

historical issues that most appear to be seizing on.

In summary, Ebix looks like a giant version of many of the

startups I used to work with, operationally speaking... messy but

dynamic.  One thing I learned from those environments was that being in the

right place at the right time could be much more important than

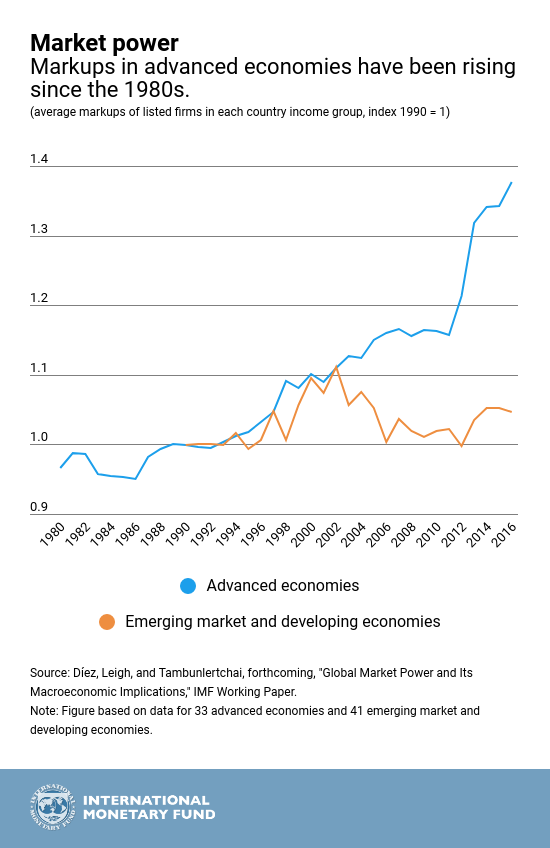

careful planning. In all of my market outlook, I've talked about

need

for reform in conjunction with a gradual shift away from

American-centric businesses and the market darlings that have been

inflated by consensus investing. I think the chart to the right,

from

the IMF speaks volumes about how Ebix is positioned for a

time when index values may struggle, but commerce and global

markets will move on. When I look at it in the context of another

round of bankruptcy rumors

for PG&E, and the (unwarranted, in my opinion, energy

contracts tend to get paid no matter what) effect they are having

on safe stocks like CWEN(A), it's hard to give market assessments

of risk all that much credibility. EBIX is certainly not without

risk, but it seems to be moving in the right direction. If the

company takes a while to cross the Ts and dot the Is, that's a

situation I'm willing to ride out, in return for a fairly unique

opportunity.

One thing I learned from those environments was that being in the

right place at the right time could be much more important than

careful planning. In all of my market outlook, I've talked about

need

for reform in conjunction with a gradual shift away from

American-centric businesses and the market darlings that have been

inflated by consensus investing. I think the chart to the right,

from

the IMF speaks volumes about how Ebix is positioned for a

time when index values may struggle, but commerce and global

markets will move on. When I look at it in the context of another

round of bankruptcy rumors

for PG&E, and the (unwarranted, in my opinion, energy

contracts tend to get paid no matter what) effect they are having

on safe stocks like CWEN(A), it's hard to give market assessments

of risk all that much credibility. EBIX is certainly not without

risk, but it seems to be moving in the right direction. If the

company takes a while to cross the Ts and dot the Is, that's a

situation I'm willing to ride out, in return for a fairly unique

opportunity.

CrowdWisers™

CrowdWisers™