--- the subscriber area has no ads and those above are not selected or endorsed by this site ---

introducing Ebix +4

17:06 16-Nov-18

Following up on the mention this morning, I am adding Ebix to my

pick list. The company describes itself as a supplier of

software and e-commerce solutions to the insurance industry.

However, lately, it has also branched out into payment,

logistics,

e-learning,

and travel

services. I have kept an intermittent eye on the company for

over a year and think this is a good entry point based a

combination of valuation and market dynamics, whereas the

medium-term thesis concerns growth and

international exposure, particularly to India.

In some ways the company is similar to BGC Partners, in

that it has grown both organically and through acquisition.

Although I can't say that management is necessarily of the same

quality, I also like the even greater exposure to (but not

direct involvement in) the insurance industry, which should

benefit from both the financial and physical climate. The

company has big name clients like John Hancock, MetLife

& BoAML, but more immediate growth is expected to come

from India.

In fact, India already accounts for more than half of

all revenue, and that concentration is expected to grow. The

exposure is a big part of the attraction to me.

Following cash reforms, electronic payments in India should be

an even larger growth driver; management projects 20-30% per

year following recently secured licenses from the central bank.

It also expects to IPO the business in late 2019, after

the Indian elections. I project that will go better than Newmark

did. Whereas BGC was racing against the commercial real estate

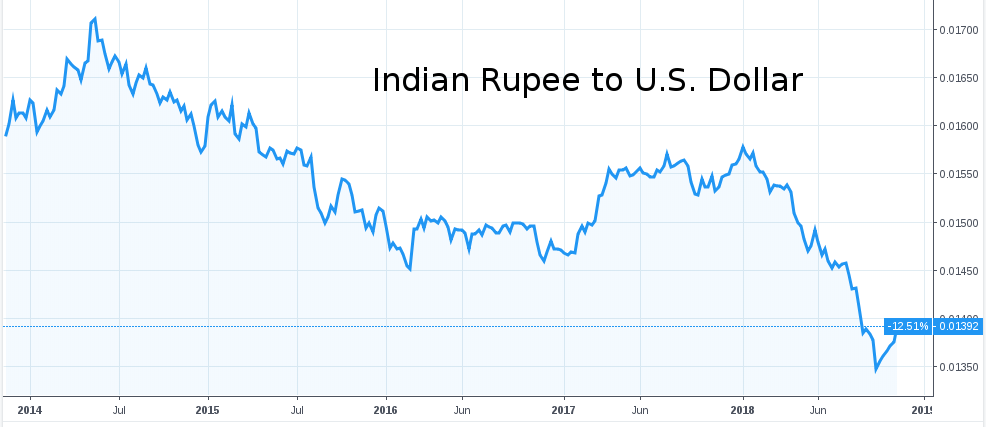

market clock, I think the rupee may have just bottomed.

That's one catalyst, since the bottom line miss in the company's

recent report is completely attributable to currency, largely due

to the rupee depreciating over 10% this year alone. Top line and

cash flows were both records, with cash from operations growing

183% YoY and 81% QoQ. Although, this growth is acquisition and

debt-fueled, it is no flash in the pan. Ebix has consistently

been amongst the 100 fastest growing companies in the world over

the past decade. For the record, BGC Partners debuts

at #59 this year, but inclusion is by no means a recommendation,

as UDC ranks

#60. The point is that as long as Ebix continues to grow

wisely, the debt looks manageable, though interest rates should

be monitored as it is LIBOR (+2.25%) indexed.

Which leads me to another catalyst, which will be the move to a

big-4 accounting firm in the first quarter. News of a change from

the old firm is what exacerbated a drop along with the market from

highs over $80 per share, even though management has said there

were no

disagreements. I note that the conference call was

rather short, with limited analyst interaction. My experience

is that many analysts, even on the buy side, don't want to go

out on a limb trying to check books on their own. The in-house

thinking is often, could I be blamed for a mistake? I expect

that mentality to be off the table by second half of next year,

with a resulting increase in coverage and enthusiasm.

That said, risks do remain with any such change, and certainly

with such a broad set of businesses in places like India. EBIX is

not quite GRoDT, but definitely one of the riskiest stocks I'm

covering. Even so, I think the recent drop is completely

non-commensurate. From a pure valuation perspective, EBIX sports

a hybrid P/E of 13, which is reasonably cheap for this sort of

growth and business model. A P/E of 15 plus 5% for rebounding

currency puts my near-term price target at $59, with realistic

hopes for at least $65 by the end of next year, and higher if the

EbixCash IPO goes off as planned.

The other thing that could be contributing to the current drop is market dynamics surrounding options expiration and a 5-1 stock split, which should be ratified today and effective within a month. Elevated shorted float indicates a pattern is similar to what I've been going on about in hydrocarbon markets, where over-extended traders reinforce a trend, but only temporarily. EBIX has no rebate rate to speak of. So, although I don't expect pricing to fully correct next week, especially with the holidays coming up, I also don't see any reason for further dips. Fundamentals will reassert eventually and, in my view, this looks like a take your chances soon or be prepared to let it go entirely type of opportunity.

CrowdWisers™

CrowdWisers™